Paycheck tax calculator georgia

The State of Florida collects its version of an unemployment tax that it calls the reemployment tax. Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy.

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

. The Florida Reemployment Tax minimum rate for 20221 is 0129 and can be as high as. Georgia Alcohol Tax. Enter your income and location to estimate your tax burden.

Nevadas tax abatement law protects homeowners from sudden spikes in their property taxes. This number is the gross pay per pay period. You must withhold this tax from employee wages that exceed 200000 per.

Use the PAYucator or W-4 Check tool below and at the end of the paycheck calculator in section P163 you will see your per paycheck tax withholding amount. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Subtract any deductions and payroll taxes from the gross pay to get net pay. The simplest way to change how much tax is withheld from your paycheck is to ask your employer to withhold a specific dollar amount from each of your paychecks.

The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The PaycheckCity salary calculator will do the calculating for you. This powerful tool can account for up to six different hourly rates and works in all 50 states.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Figure out your filing status. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

When done create the W-4 and the. New ACA information reporting 1095-C 1094-C. This 09 tax applies to employees who make more than a certain income threshold which varies by filing status.

Users input their business payroll data including salary information state pay cycle marital status allowances and deductions. This marginal tax rate means that your immediate additional income will be taxed at this rate. This Georgia hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Figure out your filing status. How to use Free Calculator. The PaycheckCity salary calculator will do the calculating for you.

The law limits increases in property taxes on primary residences to 3 per year. So the tax year 2022 will start from July 01 2021 to June 30 2022. The table below shows average effective property tax rates as well as median property tax payments and home values for every county in Arkansas.

Tax rates are expressed in mills with one mill equal to 1 of tax for every 1000 in assessed property value. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for California residents only. Georgia collects gasoline taxes of 287 cents per gallon of regular gasoline.

Georgia has among the highest taxes on alcoholic beverages in the country. Nevada Property Tax Rates. The Peach States beer tax of 101 per gallon of beer is one of the highest nationally.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Computes federal and state tax withholding for paychecks. Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator.

This refers to the average annual property tax payment divided by the average property value. Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for 2022 tax year on Aug 02 2022. Towns school districts and counties all set their own rates based on budgetary needs.

If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with. In the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. What does eSmart Paychecks FREE Payroll Calculator do.

Thus even if home values increase by 10 property taxes will increase by no more than 3. Overview of Georgia Taxes Georgia has a progressive income tax system. Dont want to calculate this by hand.

How You Can Affect Your Alabama Paycheck. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Whether you deposit FUTA tax quarterly or annually youll use Form 940 to summarize the tax you owe.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Payroll check calculator is updated for payroll year 2022 and new W4. Your average tax rate is 165 and your marginal tax rate is 297.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. Paycheck Managers Paycheck Calculator is a free service available for anyone and no account is required for use. This number is the gross pay per pay period.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Say for example you want to withhold 50 from each paycheck. Flexible hourly monthly or annual pay rates bonus or other earning items.

Gross pay and pay frequency. Dont want to calculate this by hand. Allowances and withholding information.

So the tax year 2021 will start from July 01 2020 to June 30 2021. Additional Medicare tax. Property Tax Rates in Arkansas.

Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. Another way of looking at property taxes is the average effective rate. There is a line on the W-4 that allows you to specify additional withholding.

It is not a substitute for the advice of an accountant or other tax professional. Follow the steps below to calculate your take home pay after state income tax. The state and a number of local government authorities determine the tax rates in New Hampshire.

Texas state income tax. The amount of tax that you withhold from each employees paychecks varies based on their earnings filing status and other factors. Plus you will find instructions on how to increase or decrease that tax withholding amount.

Switch to Georgia salary calculator. Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator. Minnesota tax year starts from July 01 the year before to June 30 the current year.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. Florida Payroll Taxes and Rules Florida Reemployment Tax. There are numerous tax districts within every Nevada.

Texas tax year starts from July 01 the year before to June 30 the current year. For diesel purchases the tax rate is 322 cents per gallon. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

New Hampshire Property Tax Rates.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Free Online Paycheck Calculator Calculate Take Home Pay 2022

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Payroll Tax Calculator For Employers Gusto

![]()

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes For Your Small Business

Income Tax Calculator Estimate Your Refund In Seconds For Free

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Georgia Sales Reverse Sales Tax Calculator Dremploye

Georgia Paycheck Calculator Smartasset

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Take Home Pay Calculator

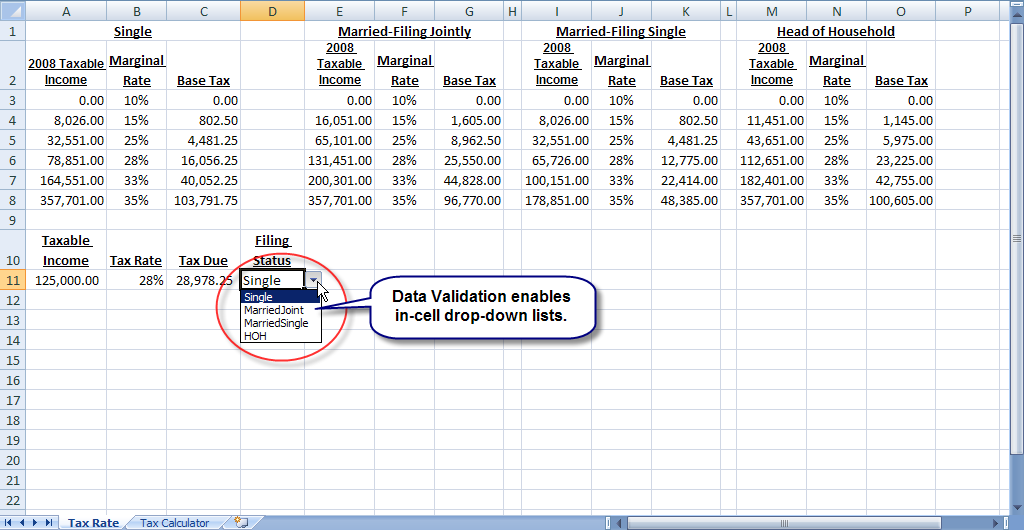

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Estimate Taxes For 2020 Top Sellers 53 Off Www Ingeniovirtual Com