46+ mortgage insurance premiums may be deductible

Web You can deduct Mortgage Insurance Premiums PMI paid to the VA loan. Web Mortgage insurance protects the lender in case you default on your loan.

Homes Land Volume 46 Issue 12 By Homes Land Of Ocala Marion County Issuu

Web See Line 13 in the instructions for Schedule A Form 1040 and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct.

. Be aware of the phaseout limits however. MIP is not deductible if you have a government-backed loan such as an FHA VA or. 1 are paid or accrued before Jan.

Web It may be deductible on some States tax returns. Web To deduct the premiums the insurance policy must be for home acquisition debt - a loan to buy build or improve - your first or second home. Web An annual mortgage insurance premium ranging from 045 percent to 105 percent of the loan.

The exact amount will depend on the loan term 15 years 30 years. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Also your adjusted gross income cannot go over 109000.

Mortgage insurance policies on. Web You can deduct this whole sum. Prepaid insurance premiums can be designated over the term of the credit or 84 months whichever period is more limited.

Web Mortgage insurance premiums used to be deductible just like mortgage interest. Web Qualified mortgage insurance premiums are deductible as qualified residence interest if the amounts. Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies.

Web Read about the Mortgage Insurance Tax Deduction Act of 2017. There is a limit on a deduction though based on your Adjusted Gross Income and filing. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction.

Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Be aware of the phaseout. However higher limitations 1 million 500000 if married.

This deduction is available if you own a home that is in. Once your income rises to this level. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web The mortgage insurance premium tax deduction can reduce your taxable income by up to 1000 per year. Web Ryan can deduct 880 9240 84 x 8 months for qualified mortgage insurance premiums in 2019. For 2020 Ryan can deduct 1320 9240 84 x 12 months if his.

Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders. However the 2017 Tax Cut and Jobs Act eliminated this deduction.

How Much Life Insurance Coverage Should You Buy Mymoneysage Blog

Business Succession Planning And Exit Strategies For The Closely Held

News

Pdf Jucpa Volume 10 Number 4 April 2013 Sherry Woo Academia Edu

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Is Mortgage Insurance Tax Deductible Bankrate

Xlc 2013 28r Pl By Www 28r Pl Issuu

A Guide To Business Relocation In Europe 2012 13

What Is A Homeowners Insurance Declaration Page Quicken Loans

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

World Press Trends World Association Of Newspapers

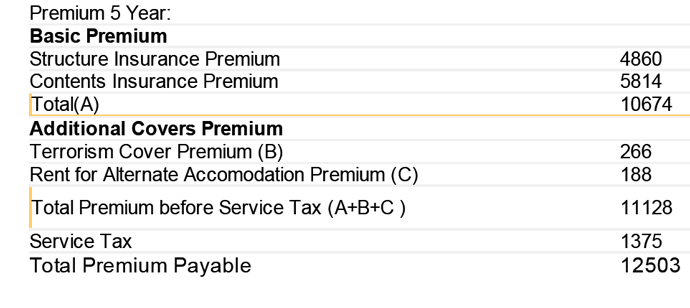

How Is The Home Insurance Premium Calculated

Is Mortgage Insurance Tax Deductible Bankrate

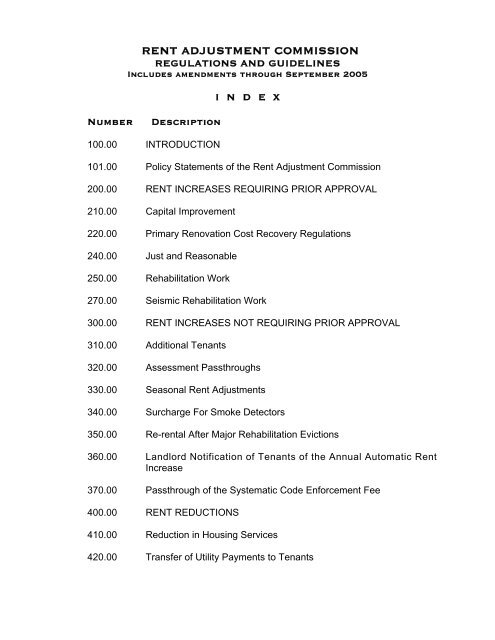

Rent Adjustment Commission California Tenant Law

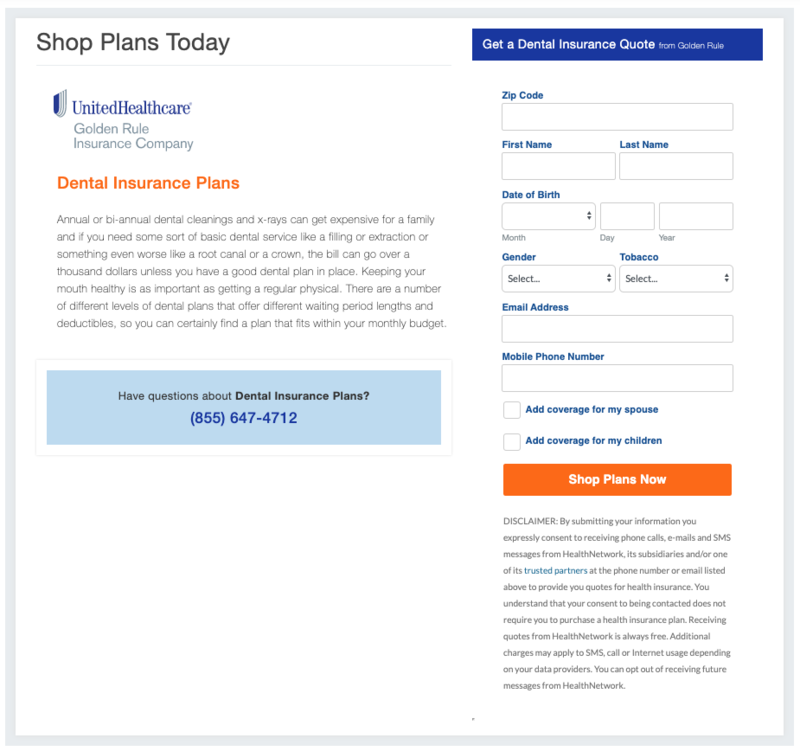

Best Dental Insurance Of 2023 Consumersadvocate Org

Calculation Of Insurance Premiums Youtube

Life Insurance Premium Deduction U S 80c Simple Tax India